Renewable Portfolio Standards and Mandates: A Deep Dive into the Green Path

Introduction:

Renewable Portfolio Standards (RPS) and mandates have emerged as pivotal instruments in steering nations and regions toward a greener and more sustainable energy future.

In this comprehensive exploration, we delve into the intricacies of these policies, shedding light on their significance, implementation.

And the profound impact they have on driving the adoption of renewable energy sources.

Understanding Renewable Portfolio Standards (RPS):

Renewable Portfolio Standards, also known as Renewable Energy Standards (RES), represent a set of regulations enacted by governments to mandate a specified percentage of electricity generation to come from renewable sources.

This policy tool serves as a compelling mechanism to diversify energy portfolios, reduce greenhouse gas emissions, and accelerate the integration of clean energy into the power grid.

Implementation and Targets:

Governments set ambitious targets within RPS, compelling utilities and energy providers to procure a certain portion of their electricity from renewable sources.

These targets typically escalate over time, creating a dynamic framework that encourages ongoing investments in renewable energy infrastructure.

Variability Across Regions:

One notable aspect of RPS is its adaptability to regional contexts.

Different jurisdictions may have distinct targets, timelines, and definitions of eligible renewable sources.

This variability allows for flexibility in aligning policies with local resources, encouraging a tailored approach to clean energy adoption.

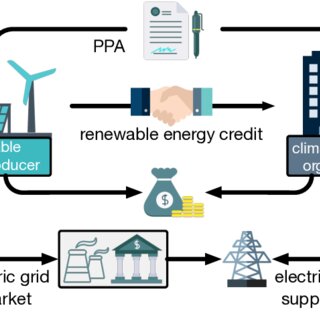

Compliance Mechanisms:

To adhere to RPS, utilities may employ various compliance mechanisms, including investing in renewable energy projects, purchasing Renewable Energy Credits (RECs), or entering into Power Purchase Agreements (PPAs) with renewable energy producers.

These mechanisms create a market for clean energy, stimulating investments and fostering the growth of the renewable sector.

Benefits and Impacts:

The implementation of RPS has far-reaching benefits, contributing to a reduction in carbon emissions, increased energy security, and the creation of jobs in the renewable energy sector.

Furthermore, by establishing a clear market demand for clean energy, RPS serves as a catalyst for technological innovation and cost reductions in renewable technologies.

Challenges and Adaptations:

While RPS has proven effective in many regions, challenges such as intermittent energy production and grid integration must be addressed.

Governments are adapting RPS policies to accommodate emerging technologies, storage solutions, and grid enhancements, ensuring a seamless transition to a more sustainable energy landscape.

Global Perspectives:

RPS and mandates are not confined to specific countries; they have gained traction globally.

Nations worldwide are adopting or considering similar policies to accelerate the shift towards clean energy and meet international climate goals.

Renewable Portfolio Standards and mandates are at the forefront of the global effort to transition to cleaner, more sustainable energy sources.

As governments continue to refine and expand these policies, their impact will resonate across industries, economies, and the environment, propelling us toward a future where green energy is not just an option but an imperative.

Countries that have Embraced Renewable Portfolio Standards

Several countries and governments around the world have embraced Renewable Portfolio Standards (RPS) or similar policies to promote the adoption of clean and sustainable energy sources.

Here are some of the countries listed below.

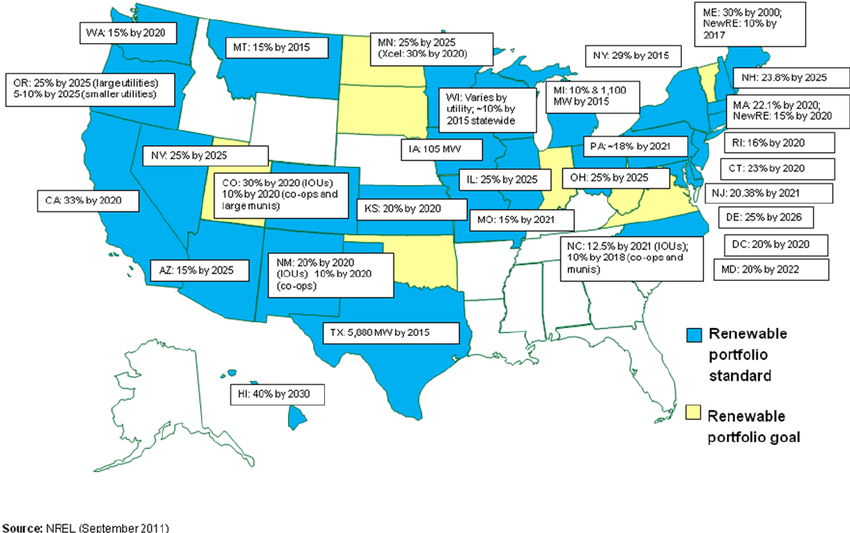

- United States:

- The United States has been a pioneer in implementing Renewable Portfolio Standards. Many states, including California, New York, and Texas, have established RPS targets with the aim of increasing the share of renewable energy in their electricity mix. These targets vary by state, contributing to a diverse and decentralized approach to clean energy adoption.

- European Union:

- The European Union has set ambitious renewable energy targets for its member states. The EU’s Renewable Energy Directive outlines binding targets for each member country to achieve a specific share of renewable energy in its final energy consumption. This directive serves as a foundation for national policies, including Renewable Portfolio Standards, in EU member states.

- China:

- China, as a global leader in renewable energy capacity, has set targets and implemented policies to increase the share of renewables in its energy mix. While not strictly an RPS, China’s renewable energy goals and supportive policies play a crucial role in driving the deployment of wind, solar, and other clean energy technologies.

- India:

- India has been actively promoting renewable energy through various policies, including the National Action Plan on Climate Change and the National Solar Mission. While not explicitly RPS, these initiatives set ambitious targets for renewable energy deployment, encouraging both central and state governments to increase the share of clean energy in their respective energy portfolios.

- Australia:

- Australia’s states and territories have individually implemented Renewable Energy Targets (RETs) or Renewable Portfolio Standards to drive the transition to renewable energy. For example, states like South Australia and Victoria have set specific targets for the share of renewable energy in their electricity generation.

- Canada:

- Canada’s provinces have implemented a mix of policies, including Renewable Portfolio Standards, to increase the use of renewable energy. Provinces such as Ontario and Quebec have established targets and mechanisms to promote the development of renewable energy projects.

- Japan:

- Japan has set renewable energy targets as part of its efforts to transition away from nuclear power and reduce greenhouse gas emissions. While not explicitly labeled as RPS, Japan’s policies aim to increase the use of renewable energy sources, including solar and wind.

It’s important to check for the most recent developments in renewable energy policies in each country, as governments may update or introduce new initiatives to align with evolving energy and environmental goals.

Additionally, the effectiveness and implementation of these policies can vary, and periodic reviews may occur to assess progress and make necessary adjustments.

Unlocking Investment Opportunities: Investing in Renewable Portfolio Standards (RPS)

Renewable Portfolio Standards (RPS) present an enticing avenue for investors looking to align their portfolios with the global transition towards clean and sustainable energy.

As countries and regions commit to increasing the share of renewables in their energy mix, numerous investment opportunities emerge within the renewable energy sector.

Here’s a comprehensive guide on how investors can navigate and capitalize on these opportunities.

1. Understand RPS Regulations:

- Before diving into investments, it’s crucial for investors to have a thorough understanding of the RPS regulations in the targeted region. Familiarize yourself with the specific targets, compliance mechanisms, and eligible renewable energy sources outlined in the policies. This understanding will guide investment decisions and help identify sectors poised for growth.

2. Invest in Renewable Energy Projects:

- Direct investment in renewable energy projects, such as solar farms, wind farms, and hydropower plants, is a primary avenue for investors. These projects often require significant capital for development, making them attractive opportunities for institutional and private investors. Investing in such projects can offer both steady returns and contribute to the growth of clean energy infrastructure.

3. Explore Publicly Traded Companies:

- Consider investing in publicly traded companies involved in the renewable energy sector. Companies engaged in the development, manufacturing, and operation of renewable energy technologies, as well as those specializing in energy storage solutions, can provide exposure to the growing demand for clean energy.

4. Renewable Energy Exchange-Traded Funds (ETFs):

- ETFs focused on renewable energy offer a diversified approach to investing in the sector. These funds typically include shares of multiple companies involved in various aspects of the renewable energy supply chain. Investors can gain exposure to the entire industry without the need for individual stock selection.

5. Infrastructure Funds:

- Infrastructure funds dedicated to renewable energy projects can be attractive for long-term investors seeking stable returns. These funds often finance the construction and operation of renewable energy assets, providing investors with a portfolio of income-generating projects.

6. Green Bonds:

- Green bonds are fixed-income securities specifically earmarked for financing environmentally friendly projects, including those related to renewable energy. Investing in green bonds allows investors to support RPS-driven initiatives while earning interest on their investments.

7. Yieldcos:

- Yieldcos are publicly traded companies created to own and operate income-generating assets, such as renewable energy projects. These entities typically distribute a significant portion of their cash flows to shareholders in the form of dividends, providing investors with a source of steady income.

8. Venture Capital and Startups:

- For investors seeking higher-risk, higher-reward opportunities, exploring venture capital investments in renewable energy startups can be an option. Startups often bring innovative technologies to the market and may present lucrative opportunities for early investors.

9. Energy Storage Investments:

- With the increasing importance of energy storage in supporting intermittent renewable sources, consider investments in companies specializing in battery technologies and energy storage solutions. As the demand for reliable energy storage grows, these investments can be strategically positioned for future gains.

10. Stay Informed on Policy Developments:

- Renewable energy investments are closely tied to regulatory and policy developments. Stay informed about changes in RPS targets, government incentives, and emerging policies that may impact the renewable energy sector.

- This knowledge will help investors anticipate market trends and make informed investment decisions.

Investing in Renewable Portfolio Standards offers a dynamic and evolving landscape of opportunities.

Whether through direct project investments, publicly traded companies, or innovative startups.

Investors have the chance to not only generate financial returns but also contribute to the global transition to a more sustainable and cleaner energy future.

As the world embraces renewable energy targets, strategic investments in this sector can position investors for long-term success.

NGOs and Organizations would be Investors should Approach for Business

Engaging with Non-Governmental Organizations (NGOs) and organizations is a strategic approach for investors seeking to align their businesses with sustainable and socially responsible practices.

These entities often play a pivotal role in promoting environmental, social, and governance (ESG) initiatives.

Here’s a guide on key NGOs and organizations investors may consider approaching for business collaborations and partnerships:

- World Wide Fund for Nature (WWF):

- The WWF is a global organization dedicated to environmental conservation and sustainable development. Investors can approach WWF for insights on sustainable business practices, conservation projects, and strategies to reduce environmental impact. Collaborating with WWF can enhance a company’s environmental stewardship and contribute to biodiversity conservation.

- Carbon Disclosure Project (CDP):

- CDP operates a global disclosure system, encouraging companies to disclose their environmental impact, including carbon emissions. Investors can engage with CDP to access information about a company’s environmental performance and assess its commitment to sustainability. This data is valuable for investors looking to make informed decisions aligned with climate-conscious strategies.

- Sustainable Accounting Standards Board (SASB):

- SASB provides industry-specific sustainability accounting standards, enabling investors to evaluate the financial impact of environmental, social, and governance factors. By aligning with SASB standards, investors can gain valuable insights into a company’s material ESG risks and opportunities, facilitating better-informed investment decisions.

- Global Reporting Initiative (GRI):

- GRI sets standards for sustainability reporting, helping companies communicate their ESG performance transparently. Investors can look to GRI for guidance on assessing the sustainability practices of potential investments. Engaging with GRI-aligned companies indicates a commitment to transparency and responsible business practices.

- The Principles for Responsible Investment (PRI):

- PRI is a global initiative that promotes responsible investment practices. Investors can join PRI and collaborate with other signatories to advance ESG principles. Engaging with PRI helps investors integrate sustainability considerations into their investment strategies and actively contribute to responsible investing initiatives.

- Rainforest Foundation:

- For investors with a focus on biodiversity conservation and sustainable resource management, the Rainforest Foundation is a key organization. Collaborating with the foundation can support initiatives that protect vital ecosystems, promote sustainable forestry practices, and contribute to the overall well-being of local communities.

- Clean Energy Finance Corporation (CEFC):

- The CEFC is an Australian organization dedicated to accelerating investment in clean energy. Investors interested in renewable energy projects or technologies can explore collaboration with the CEFC to access funding, expertise, and opportunities aligned with the transition to a low-carbon economy.

- United Nations Global Compact (UNGC):

- The UNGC is the world’s largest corporate sustainability initiative, encouraging businesses to adopt sustainable and socially responsible policies. Investors can engage with UNGC to identify companies committed to its principles and support sustainable business practices globally.

- Impact Investing Institute:

- Impact investing aims to generate positive social and environmental impact alongside financial returns. Investors interested in aligning their portfolios with impact investing goals can collaborate with the Impact Investing Institute to access resources, networks, and opportunities in the impact investing space.

- B Lab:

- B Lab is the nonprofit organization behind the B Corp certification, recognizing companies committed to meeting high standards of social and environmental performance. Investors interested in supporting and collaborating with B Corps can explore opportunities to engage with B Lab and its network.

When approaching these NGOs and organizations, investors should express a genuine commitment to sustainability, responsible business practices, and positive societal impact.

Collaborating with these entities not only enhances a company’s ESG profile but also contributes to a broader movement for sustainable and ethical business practices globally.

CONCLUSION

Renewable Portfolio Standards and Mandates: A Deep Dive into the Green Path

In the symphony of global energy transformation, the resonance of Renewable Portfolio Standards (RPS) and mandates echoes with promise, ushering in a new era of sustainable progress.

This exploration into the green path reveals not just a set of policies but a collective commitment from governments, businesses, and investors to rewrite the narrative of our energy future.

As we conclude this deep dive into the dynamics of RPS, the reverberations of its impact are felt across borders, industries, and the very fabric of our societies.

A Symphony of Change: At its core, RPS serves as a conductor orchestrating a symphony of change.

It compels nations and regions to harmonize their energy portfolios, blending the timeless melodies of sunlight, wind, water, and earth into a composition that resonates with environmental stewardship and economic prudence.

This orchestrated transition is not a mere trend but a fundamental shift towards resilience, sustainability, and a harmonious coexistence with our planet.

A Mosaic of Regional Initiatives: What emerges from this exploration is a mosaic of regional initiatives, each brushstroke representing a commitment to a greener, cleaner future.

From the wind-swept plains of the United States to the solar-rich landscapes of India, countries are crafting their unique contributions to this masterpiece.

Through tailored RPS targets and mandates, governments are not only reducing carbon footprints but also fostering localized solutions that echo the needs and resources of their communities.

It beckons industries to reinvent their energy strategies, encouraging a shift from traditional fossil fuels to cleaner, renewable alternatives.

Embracing RPS is not just a regulatory obligation; it is an opportunity for businesses to redefine their narratives, enhance operational efficiency, and contribute to a healthier planet for generations to come.

Investors Navigating the Green Seas: In the world of investments, RPS emerges as a compass guiding investors through the green seas of opportunity.

It beckons them to explore renewable energy projects, engage with publicly traded companies championing clean technologies, and support ventures that embody the ethos of sustainability.

The integration of ESG principles becomes not just a trend but a fundamental consideration in navigating the shifting tides of the investment landscape.

A Kaleidoscope of Innovation: What unfolds is a kaleidoscope of innovation, where technological advancements and policy evolution converge.

The canvas is painted with solar panels that capture the brilliance of the sun, wind turbines that harness the power of the breeze, and energy storage solutions that tame the unpredictable nature of renewable resources.

This tapestry of innovation, woven with the threads of RPS, reflects a commitment to a future where our energy needs are met without compromising the well-being of our planet.

Challenges as Catalysts for Progress: Yet, as we delve deeper, we encounter challenges—intermittency, grid integration, and the need for technological breakthroughs.

These challenges, however, are not roadblocks but catalysts for progress. Governments, businesses.

And researchers unite to tackle these hurdles head-on, propelling us towards solutions that make renewable energy not just a supplement but a reliable and mainstream source of power.

Conclusion: A Call to Collective Action: As we navigate the intricate pathways of Renewable Portfolio Standards and mandates, we are reminded that this journey is not a solitary one.

It is a collective odyssey, a call to action that transcends geographical boundaries and transcends industry sectors.

Governments, businesses, investors, and individuals—all are integral players in this transformative saga.

In conclusion, the exploration into the green path, guided by RPS and mandates, is an expedition into a future where clean energy is not a choice but an imperative.

It is a future where the symphony of wind and sun accompanies our progress, where the mosaic of regional initiatives paints a portrait of sustainable prosperity, and where challenges become stepping stones to a greener tomorrow.

As we collectively embark on this profound journey, let our footsteps echo not just with the strides of progress but with the heartbeat of a planet rejuvenated and thriving.

The deep dive into the green path is not just an exploration; it is a commitment to a legacy of sustainability, resilience, and a brighter, cleaner world for generations to come.

Leave a Reply