The Vital Role of Carbon Pricing and Emission Reduction Targets: 5 Countries Leading the Charge

Introduction:

As the global community intensifies its efforts to combat climate change, the implementation of effective strategies becomes paramount.

Carbon pricing and emission reduction targets emerge as pivotal tools in the battle against rising greenhouse gas emissions.

This article delves into the significance of carbon pricing, explores emission reduction targets, and underscores their collective impact on fostering a sustainable future.

Carbon Pricing: A Catalyst for Change:

Carbon pricing involves assigning a monetary value to carbon emissions, incentivizing businesses and industries to reduce their carbon footprint.

By incorporating market mechanisms such as carbon trading and taxation, this approach encourages the adoption of cleaner technologies and practices.

Companies are motivated to innovate and invest in sustainable solutions, thereby contributing to a lower-carbon economy.

Emission Reduction Targets: Setting the Bar for Sustainability:

Governments and organizations worldwide are setting emission reduction targets as part of their commitment to the Paris Agreement.

These targets aim to limit global temperature increases and promote sustainable development.

Exploring the various emission reduction goals and their implications provides insights into the collective effort required to achieve a net-zero future.

Balancing Act: Integrating Carbon Pricing with Emission Reduction Targets:

Successful climate action involves a harmonious integration of carbon pricing and emission reduction targets.

Companies adopting comprehensive strategies align their financial incentives with ambitious emission reduction goals.

Understanding how these two components complement each other is crucial for devising effective policies that drive long-term sustainability.

Global Impact and Challenges: Navigating the Road Ahead:

Analyzing the global impact of carbon pricing and emission reduction targets highlights the need for international cooperation.

While progress has been made, challenges persist in implementing consistent policies and regulations.

This section explores the current landscape, potential obstacles, and the importance of a unified approach to address environmental challenges.

A Path Forward for a Greener Tomorrow:

In conclusion, carbon pricing and emission reduction targets represent critical components of a comprehensive strategy to combat climate change.

Embracing sustainable practices, fostering international collaboration, and setting ambitious goals are essential steps toward building a resilient and environmentally conscious future.

As we navigate the road ahead, the combined impact of these measures holds the key to unlocking climate solutions and ensuring a greener tomorrow for generations to come.

Leading the Charge: Countries Spearheading Global Carbon Pricing Initiatives

In the pursuit of sustainable and environmentally responsible practices, a number of countries have taken bold steps to combat climate change through the widespread adoption of carbon pricing mechanisms.

This article explores the nations that have emerged as leaders in the global effort to curb greenhouse gas emissions through comprehensive carbon pricing strategies.

1. Sweden: Pioneering Carbon Tax Implementation:

Sweden stands out as a trailblazer in the realm of carbon pricing, having introduced a carbon tax as early as 1991.

With a commitment to reducing emissions and fostering a green economy, Sweden’s success serves as a model for other nations aspiring to implement effective carbon pricing measures.

2. Canada: Proactive Approach with Carbon Pricing Across Provinces:

Canada has taken a multi-faceted approach to carbon pricing, with several provinces implementing their own systems.

Notably, the federal government introduced a nationwide carbon pricing plan, demonstrating a cohesive strategy to address emissions at both regional and national levels.

3. Germany: Emission Trading and Transition to Renewables: Keywords: Emission trading, renewable energy transition, Germany, sustainable development

Germany has embraced carbon pricing through participation in the European Union Emission Trading System (EU ETS).

Additionally, the country’s commitment to transitioning to renewable energy sources aligns with a broader strategy to reduce carbon emissions/

Showcasing a holistic approach to environmental sustainability.

4. New Zealand: A Trailblazer in Agricultural Emissions Pricing:

New Zealand has made strides in addressing emissions from its agricultural sector, a significant contributor to greenhouse gas emissions.

The country’s Emissions Trading Scheme includes agricultural emissions, reflecting a commitment to comprehensive carbon pricing that encompasses diverse sectors of the economy.

5. South Korea: Ambitious Carbon Market Expansion:

South Korea has been proactive in its efforts to combat climate change, recently announcing plans to expand its carbon market.

This move underscores the nation’s commitment to achieving ambitious emissions reduction targets and fostering a sustainable, low-carbon future.

A Global Movement Towards Carbon Pricing:

As countries increasingly recognize the urgency of addressing climate change, the embrace of carbon pricing becomes a critical element of their environmental policies.

These nations, through their proactive initiatives, are paving the way for a global movement towards sustainable practices.

Emphasizing the importance of international cooperation in mitigating the impacts of climate change.

By learning from their experiences, other countries can draw inspiration and contribute to a collective effort to build a greener and more resilient world.

The Country that Initiated first the Concept of Carbon Pricing

The concept of carbon pricing, aimed at internalizing the environmental costs associated with carbon emissions, has evolved over time.

One of the earliest instances of a nation taking steps in this direction can be traced back to Sweden in the early 1990s.

Sweden’s Pioneering Carbon Tax (1991): In 1991, Sweden became the first country to implement a carbon tax, marking a historic milestone in environmental policy.

This tax levied a charge on the carbon content of fossil fuels, effectively putting a price on carbon emissions.

The Swedish government aimed to encourage industries and individuals to reduce their carbon footprint by incorporating the environmental cost into their economic decisions.

Key Features of Sweden’s Carbon Tax Initiative:

- The tax was broad-based and applied to a range of fossil fuels, including coal, oil, and natural gas.

- Revenue generated from the carbon tax was earmarked for investments in renewable energy and sustainability projects.

- Sweden’s carbon tax was designed to send a clear signal to businesses and consumers, fostering a transition towards cleaner energy alternatives.

This early initiative by Sweden laid the groundwork for the broader concept of carbon pricing that has gained momentum globally in subsequent years.

Today, carbon pricing mechanisms, including carbon taxes and cap-and-trade systems, are implemented by various countries and regions as part of their efforts to mitigate climate change and transition to a low-carbon economy.

The Swedish example serves as an important historical precedent for the adoption of carbon pricing policies worldwide.

Unlocking Opportunities: Investing in the Future of Carbon Pricing

As the global community intensifies its focus on mitigating climate change.

The burgeoning field of carbon pricing presents a unique landscape of investment opportunities.

Governments, businesses, and investors worldwide are recognizing the financial potential of initiatives designed to reduce carbon emissions and transition towards sustainable practices.

Here’s a closer look at the investment opportunities in carbon pricing:

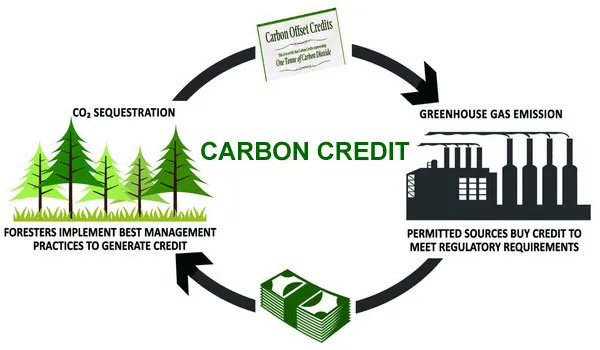

1. Carbon Markets and Trading Platforms: Key Opportunities: Carbon trading platforms, emissions allowances, carbon offset projects

Investing in carbon markets involves trading emissions allowances and offsets.

Companies are increasingly seeking emissions reductions to comply with regulations or voluntarily demonstrate their commitment to sustainability.

Investors can participate in carbon trading platforms, where the buying and selling of emissions credits take place.

Additionally, supporting or investing in carbon offset projects, such as reforestation initiatives or renewable energy projects, can provide financial returns while contributing to emissions reduction.

2. Clean Energy and Technology: Key Opportunities: Renewable energy projects, energy efficiency solutions, carbon capture and storage

Investing in clean energy and technology is a direct way to support the transition to a low-carbon economy.

Renewable energy projects, such as solar and wind farms, offer long-term investment potential.

Companies developing innovative energy efficiency solutions and technologies for carbon capture and storage are also poised for growth as the demand for sustainable alternatives continues to rise.

3. Carbon Accounting and Analytics: Key Opportunities: Carbon footprint assessment, emissions tracking software, sustainability consulting

The increasing focus on corporate sustainability has created a demand for carbon accounting and analytics services.

Companies are seeking tools and expertise to measure, report, and reduce their carbon footprint.

Investing in companies providing carbon accounting software, emissions tracking solutions, and sustainability consulting services can tap into this growing market.

4. Climate-Focused Funds and ETFs: Key Opportunities: Climate-themed investment funds, green bonds, sustainable ETFs

Investors can explore climate-focused funds and exchange-traded funds (ETFs) that prioritize companies with strong environmental performance.

Green bonds, which fund projects with positive environmental impacts, are another avenue for sustainable investing.

These financial instruments provide a diversified approach to investing in companies actively engaged in carbon reduction and sustainability efforts.

5. Carbon Offsetting Projects: Key Opportunities: Forest conservation projects, renewable energy development, methane capture initiatives

Investing in carbon offsetting projects directly contributes to emissions reduction.

Opportunities may include supporting projects that preserve forests, generate clean energy, or capture and utilize methane emissions.

These projects not only provide environmental benefits but can also yield financial returns through the sale of carbon credits.

Navigating the Green Investment Landscape:

As the world mobilizes to address climate change, the investment landscape in carbon pricing offers diverse and promising opportunities.

Investors who strategically position themselves in the evolving market can not only contribute to global sustainability but also capitalize on the growing demand for carbon-conscious solutions.

The alignment of financial goals with environmental stewardship positions carbon pricing investments as a compelling avenue for those seeking both profit and positive impact.

Strategic Partnerships: Collaborating with NGOs and Organizations for Profitable Carbon Pricing Investments

As the world transitions towards a low-carbon economy, investors seeking profitable opportunities in carbon pricing can forge strategic partnerships with non-governmental organizations (NGOs).

And specialized entities dedicated to environmental sustainability.

These collaborations not only contribute to positive environmental impact but also enhance the potential for financial returns.

Here are key NGOs and organizations that investors could cooperate with for maximum profitability in the realm of carbon pricing:

1. Carbon Trust: Opportunities for Investors: Carbon footprint certification, carbon reduction strategies

The Carbon Trust is a leading organization that works with businesses to help them reduce their carbon emissions.

Investors can collaborate with the Carbon Trust to identify companies with strong sustainability initiatives or provide funding for projects aiming to achieve carbon reduction goals.

Certifying a company’s carbon footprint through the Carbon Trust Standard can enhance its credibility and marketability.

2. Gold Standard: Opportunities for Investors: Investment in Gold Standard-certified projects, carbon offset programs

The Gold Standard is a certification body for carbon offset projects that contribute to sustainable development.

Investors can explore opportunities to invest in projects certified by the Gold Standard, such as renewable energy initiatives, afforestation projects, and community-based sustainable development programs.

Supporting such projects not only generates carbon credits but also contributes to social and environmental benefits.

3. Climate Action Reserve: Opportunities for Investors: Investing in carbon offset projects, emissions reduction initiatives

The Climate Action Reserve is a non-profit organization that operates carbon offset programs in North America.

Investors can engage with the Climate Action Reserve to identify and support high-quality carbon offset projects, particularly those in industries that may face challenges in reducing emissions.

This collaboration aligns with the goal of achieving emissions reductions while providing financial returns.

4. World Resources Institute (WRI): Opportunities for Investors: Sustainable investing, climate risk assessment

The WRI is a research organization that focuses on global environmental challenges, including climate change.

Investors can collaborate with the WRI to gain insights into climate-related risks and opportunities.

By integrating climate risk assessments into investment strategies, investors can identify companies and projects that are well-positioned for long-term profitability in a carbon-constrained world.

5. Environmental Defense Fund (EDF): Opportunities for Investors: Advocacy for sustainable policies, carbon market insights

The EDF is an NGO that works on various environmental issues, including climate change.

Investors can cooperate with the EDF to stay informed about policy developments related to carbon pricing and to advocate for sustainable policies.

This collaboration provides investors with valuable insights into emerging trends

CONCLUSION

In conclusion, the imperative for a sustainable future has cast an unyielding spotlight on the vital interplay between carbon pricing and emission reduction targets.

The trajectory toward a world grappling with the consequences of climate change necessitates transformative measures.

And at the forefront of this charge are the comprehensive strategies encapsulated in carbon pricing initiatives and ambitious emission reduction targets.

As we stand at the intersection of environmental stewardship and economic prosperity.

It is abundantly clear that the synergistic deployment of carbon pricing mechanisms and strategically calibrated emission reduction goals represents not only a pragmatic response to the perils of escalating greenhouse gas emissions.

But a beacon guiding us toward a regenerative and resilient global landscape.

Carbon pricing, with its capacity to infuse economic principles with environmental responsibility, stands as a linchpin in incentivizing industries and individuals to recalibrate their practices.

By assigning a tangible cost to carbon emissions, it not only fosters a marketplace where sustainability is a valuable commodity but propels innovation, investment, and the inexorable shift toward a low-carbon economy.

The early trailblazers in this realm, exemplified by Sweden’s pioneering carbon tax, have illuminated the path for nations worldwide to traverse as they navigate the complexities of sustainable economic growth.

Emission reduction targets, enshrined in international agreements such as the Paris Agreement, crystallize the collective will of nations to confront the existential threat of climate change.

These targets are not mere benchmarks; they are pledges to future generations, a commitment to recalibrate our relationship with the planet and ensure its vitality for posterity.

The race to achieve net-zero targets and limit global temperature increases is a rallying cry for transformative action across industries, governments, and communities.

Yet, the synergy between carbon pricing and emission reduction targets extends beyond the realms of policy and economics.

It is a moral imperative, a covenant with the delicate ecosystems that sustain life on Earth.

It is a recognition that our actions today echo through time, leaving an indelible mark on the health of the planet and the well-being of its inhabitants.

In this critical juncture, where the consequences of inaction loom large, the fusion of innovative economic instruments and ambitious climate goals is not just a strategic imperative; it is an ethical stance.

The challenges ahead are formidable, but so too are the opportunities.

Investors, businesses, and governments that embrace the convergence of economic prudence and ecological responsibility are not merely responding to a trend—

They are pioneering a new paradigm where profitability coexists harmoniously with planetary health.

The vital role of carbon pricing and emission reduction targets is not confined to a singular sector or geographical boundary.

It is a global symphony, with each participant playing a unique note, harmonizing toward the crescendo of a sustainable future.

As we navigate this complex and interconnected web of challenges and opportunities, one truth remains resolute: the choices we make today will echo across time, shaping the narrative of our collective legacy.

The call to action is resounding, and the stakes are high, but in this nexus of challenge and opportunity lies the promise of a world where economic vitality and environmental resilience are not mutually exclusive but intricately entwined for the prosperity of generations yet to come.

Leave a Reply