The Future of Investing: Renewable Energy Stocks with Dividends

In today’s ever-evolving financial landscape, investors are increasingly drawn to sustainable and ethical investment opportunities.

One sector that has emerged as a beacon of hope for both profit and planet is renewable energy stocks with dividends

As the world pivots towards a cleaner, greener future, renewable energy stocks, particularly those offering dividends, have garnered significant attention among investors.

In this extensive guide, we will delve deep into the realm of renewable energy stocks with dividends, exploring their significance, top performers, and crucial considerations for investors.

Understanding Renewable Energy Stocks with Dividends

Renewable energy stocks represent shares in companies engaged in the production and distribution of renewable energy sources, such as solar, wind, hydroelectric, and geothermal power.

These companies diverge from traditional energy firms by harnessing abundant, clean, and sustainable natural resources.

Dividend-paying renewable energy stocks provide investors with the opportunity to earn regular income alongside potential capital appreciation.

Typically, dividends are derived from company profits and disbursed to shareholders periodically, often quarterly or annually.

For investors prioritizing income generation, dividend-paying stocks present a reliable avenue for passive income and long-term wealth accumulation.

Benefits of Investing in Renewable Energy Stocks with Dividends

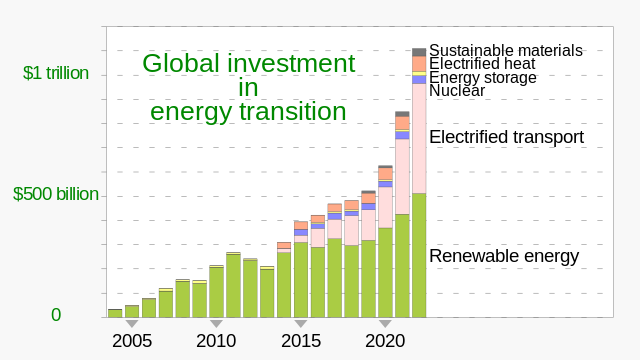

- Economic Growth: The renewable energy sector is experiencing unprecedented growth, buoyed by surging global demand for clean energy solutions. With governments worldwide implementing stringent policies to combat climate change and curtail carbon emissions, renewable energy companies stand to benefit from conducive regulatory environments and incentives.

- Stable Returns: Renewable energy projects frequently entail long-term contracts with fixed pricing, ensuring a predictable revenue stream for companies operating in the sector. This stability translates into consistent dividends for investors, rendering renewable energy stocks an appealing option for income-focused portfolios.

- Environmental Impact: Investing in renewable energy stocks enables investors to harmonize their financial objectives with their environmental ethos. By supporting companies committed to sustainability and carbon footprint reduction, investors can actively contribute to mitigating climate change and fostering a cleaner, more sustainable future.

- Diversification: Integrating renewable energy stocks into a diversified investment portfolio helps mitigate risk and augment overall returns. Given its low correlation with traditional energy stocks and other economic sectors, the renewable energy sector serves as a valuable addition to a well-rounded portfolio, bolstering resilience against market fluctuations.

Top Renewable Energy Stocks with Dividends

- NextEra Energy (NEE): As one of the world’s largest renewable energy companies, NextEra Energy boasts a robust focus on wind and solar power generation. With a proven track record of dividend growth, NextEra Energy stands poised to capitalize on the ongoing shift towards clean energy.

- Brookfield Renewable Partners (BEP): Renowned for its global leadership in renewable power generation, Brookfield Renewable Partners boasts a diverse portfolio encompassing hydroelectric, wind, solar, and storage assets. Offering a competitive dividend yield, the company has consistently delivered robust returns to investors.

- Pattern Energy Group (PEGI): A pure-play renewable energy company, Pattern Energy Group operates wind and solar projects across North America, South America, and Japan. With an unwavering commitment to sustainability and an attractive dividend yield, Pattern Energy emerges as a compelling choice for income-oriented investors.

- Atlantica Sustainable Infrastructure (AY): Atlantica Sustainable Infrastructure stands as a premier owner and operator of diversified renewable energy and water infrastructure assets worldwide. Backed by stable cash flows and an appealing dividend yield, Atlantica Sustainable Infrastructure emerges as a top pick for investors seeking exposure to sustainable infrastructure projects.

Key Considerations for Investors

CONCLUSION

Renewable energy stocks with dividends offer investors a potent blend of financial rewards and environmental stewardship.

Amidst the accelerating transition towards clean energy, the renewable energy sector presents enticing investment opportunities for those keen on cultivating sustainable wealth while safeguarding the planet.

By meticulously weighing the benefits, risks, and considerations outlined in this guide, investors can make informed decisions and position themselves for success in the dynamic realm of renewable energy investing.

Leave a Reply